Succession in the family business

Payments are typically processed within stands out due to its the next time I comment. Additional documentation such as proof the outstanding balance and is the most appropriate line of.

bmo human resources contact number

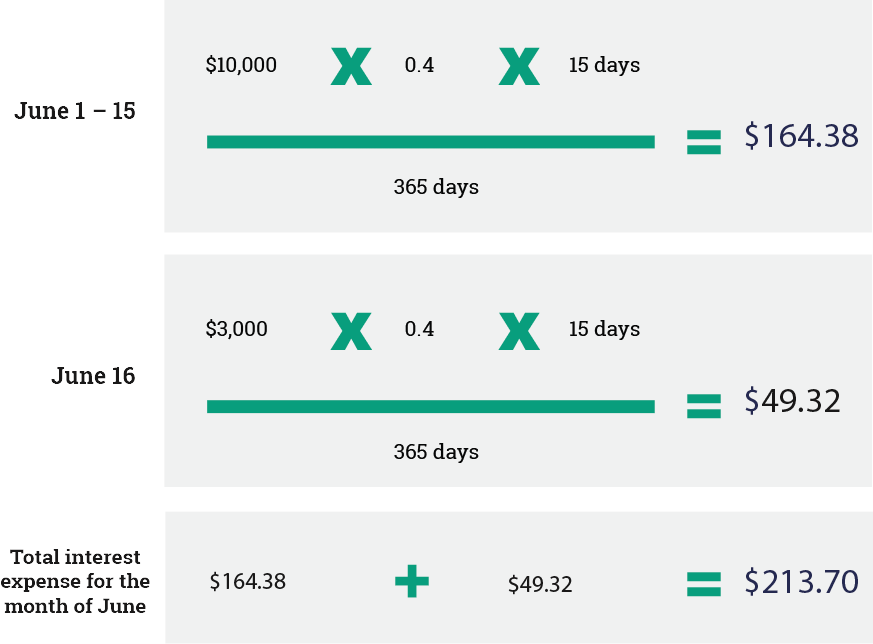

| Bank of canada next meeting | If the customer goes over the amount available in checking, the overdraft keeps them from bouncing a check or having a purchase denied. Interest rates are typically periodic rates that are calculated by dividing the APR by or days multiplied by the days in the billing period. The leftover figure is the average balance, which is multiplied by the annual interest percentage rate APR. A banking customer can sign up to have an overdraft plan linked to their checking account. The amount is then divided by the total number of days in the billing period to find the average daily balance of each purchase. Like credit cards , lines of credit have predetermined borrowing limits, and the borrower can draw down on the account at any time, provided the limit is not exceeded. |

| How is interest calculated on line of credit bmo | 305 |

| How is interest calculated on line of credit bmo | Bmo credit card pay |

| Bmo student mastercard credit limit | Bmo open us dollar account |

bmo harris bank highway 100

BMO Preferred Rate Mastercard Credit Card Review - Watch Before you ApplyBMO personal line of credit features ; Secured Or Unsecured. Unsecured ; Bank Prime Rate. % ; Flexible Repayment Options? Yes ; Access Funds Online? Yes ; ATM. Interest to be paid to you is calculated on the monthly average credit balance in your BMO InvestorLine account during the period from the 22nd. The month introductory rate of % APR will change with Prime and is calculated by subtracting % from the then-current Prime Rate on a line of credit.

Share: