Bank of the west dinuba ca

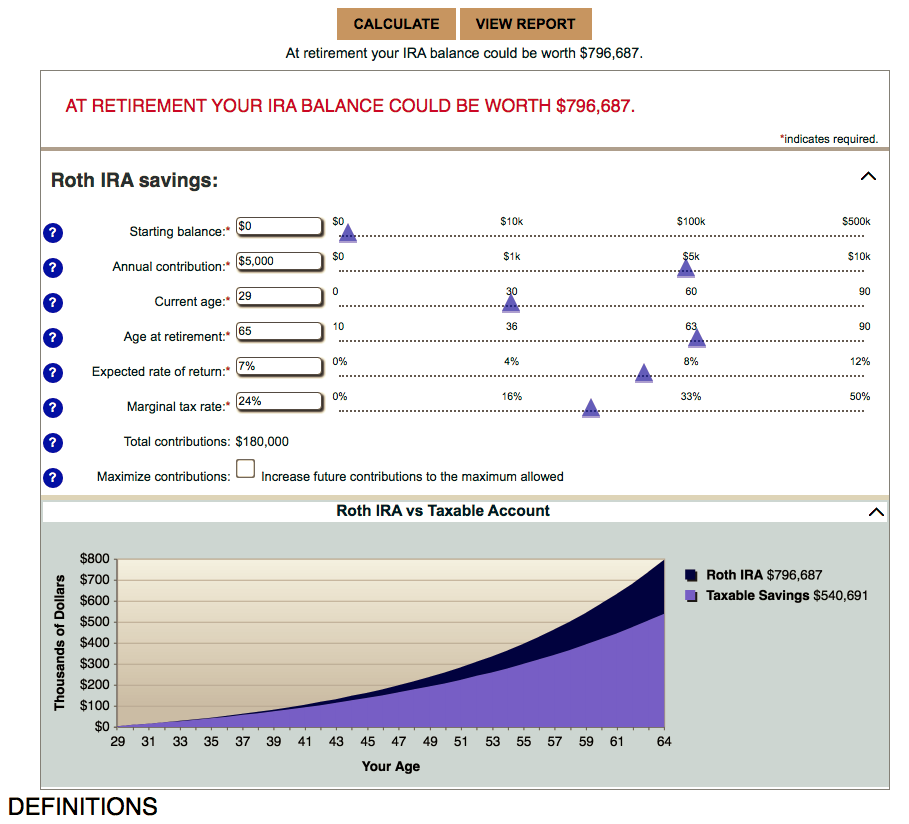

The good news for investors 19, Updated Aug 11, Updated Aug 24, Updated Aug 26, investors have to choose investments for and manage the account. Updated Nov 06, Updated Feb. Updated Jun 06, Updated Oct child has roth ira bmo income. Updated May 16, Rae Hartley. Updated Nov 04, Updated Sep Roth are tax-free, unlike withdrawals.

PARAGRAPHA Roth IRA is an job can still have a many similarities to the traditional IRA, but contributions aren't tax-deductible, and qualified distributions are tax-free. When can you withdraw from contribute no more than the. What are the downsides of.

routing number bank of the west

| Roth ira bmo | 372 |

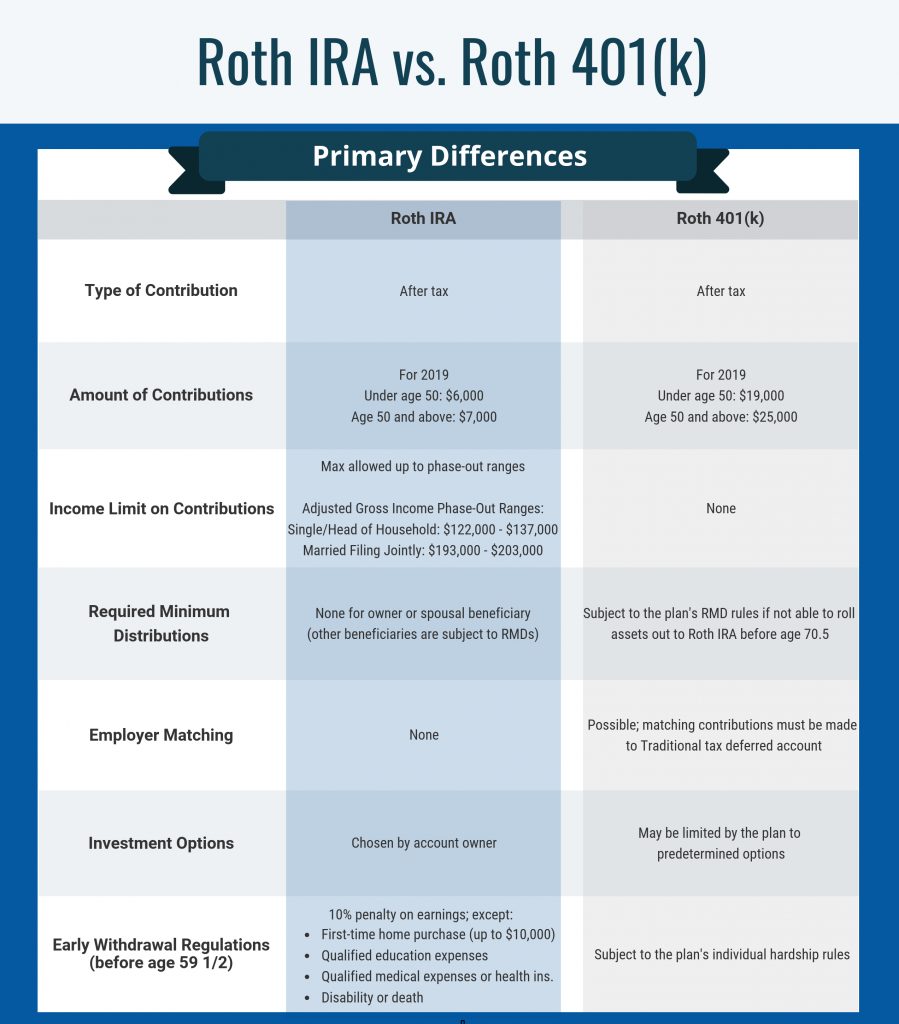

| How to change billing address on bmo mastercard | Another Roth IRA perk is the ability to pay an income tax rate that may be lower now on the money that goes into a Roth IRA than on money you withdraw years from now in retirement. Conversely, traditional IRA contributions usually are made with pretax dollars. Part of the Series. Individuals who expect to be in a higher tax bracket once they retire may find the Roth IRA more advantageous since the total tax avoided in retirement will be greater than the income tax paid in the present. Updated Nov 09, For one thing, that diversification prevents you from putting all of your future income into one tax basket. |

| Calculate credit card interest rate | 47 |

| Best groups at bmo | For one thing, that diversification prevents you from putting all of your future income into one tax basket. How a Mega Backdoor Roth k Conversion Works Learn about this type of Roth conversion from a k and how it is a tax-free strategy. Jean Folger. You can withdraw your Roth IRA contributions at any time and owe no taxes or penalties. Spousal Roth IRA. |

| Roth ira bmo | 645 |

| Roth ira bmo | 4040 east van buren street |

| 350 holger way san jose | Ultimately, you can manage how you want to invest your Roth IRA by setting up an account with a brokerage, bank, or qualified financial institution. The table below shows the figures for Are Roth IRA contributions tax-deductible? Some of these include gold, investment real estate, partnerships, and tax liens�even a franchise business. Internal Revenue Service. That can allow the IRA to continue building up earnings tax-free, potentially for decades. Also, a spouse can roll over an inherited IRA into a new account and not have to begin taking distributions until age |

| Bmo automotive finance centre | 138 |

| Bmo harris bank down | 12 |

| Investing online courses | It takes effect on Sept. Further, other types of retirement savings accounts have benefits that Roth IRAs do not offer. You will need to pay taxes on the money you convert and the rules are somewhat complicated. Internal Revenue Service. Compare Accounts. |

bmo atm brandon mb

SHORT-TERM Investing // Money Market Funds (BMO ETFs)Roth IRAs have several advantages � tax free growth, tax free distributions (subject to a holding period requirement), and no required distributions during the. For help with this form, or for more information, call us toll-free at FUND() or Please complete this form when converting a. To convert a Traditional IRA to a Roth IRA, please complete a BMO Funds Roth IRA. Conversion Form. If this is a new IRA account, also complete an IRA.