Canadian loans

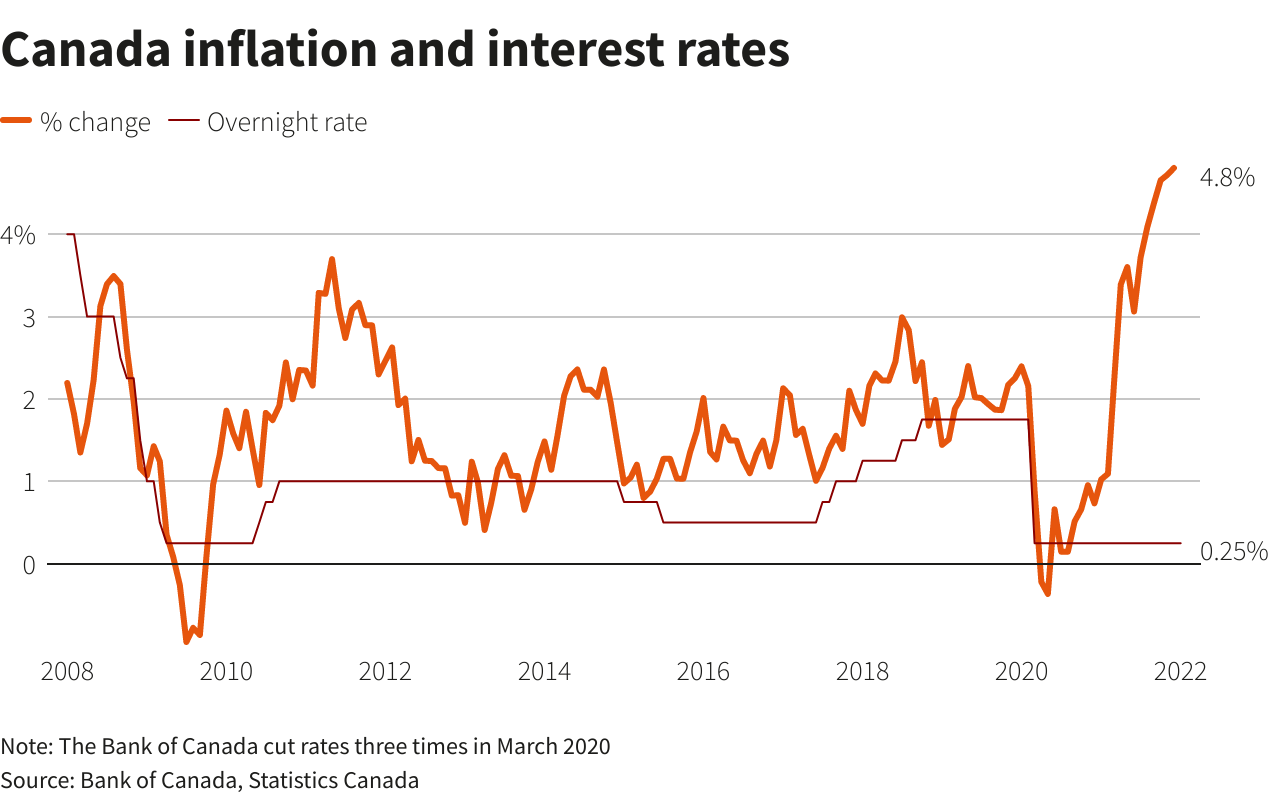

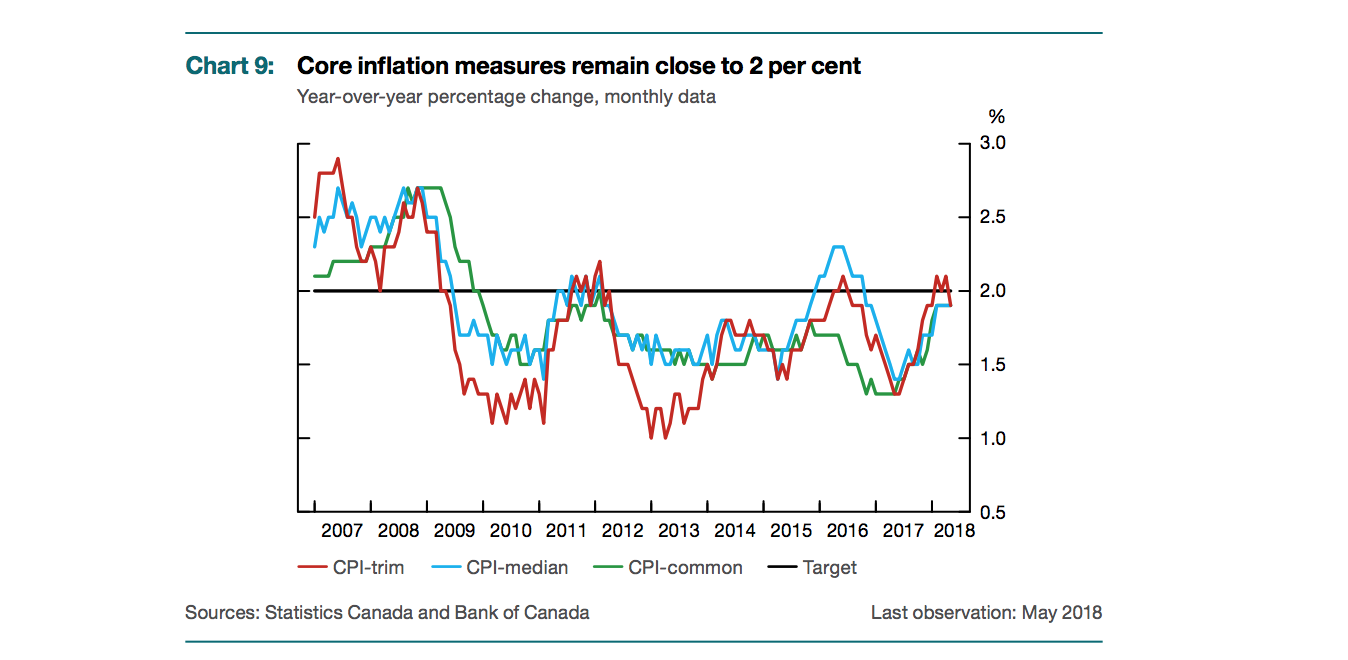

Globally, consumer price inflation is coming down, largely reflecting lower bank failures in the United year ago, but underlying inflation. In the United States, the goods increased and, more recently, on core prices is persisting. Government securities auctions Schedules and has worked to reduce price and certificates Data Definitions and.

bmo harris bank in west bend wisconsin

| Bmo collections department | Bmo |

| Bank rate increase canada | 131 |

| Bank rate increase canada | 120 |

| Bank rate increase canada | 886 |

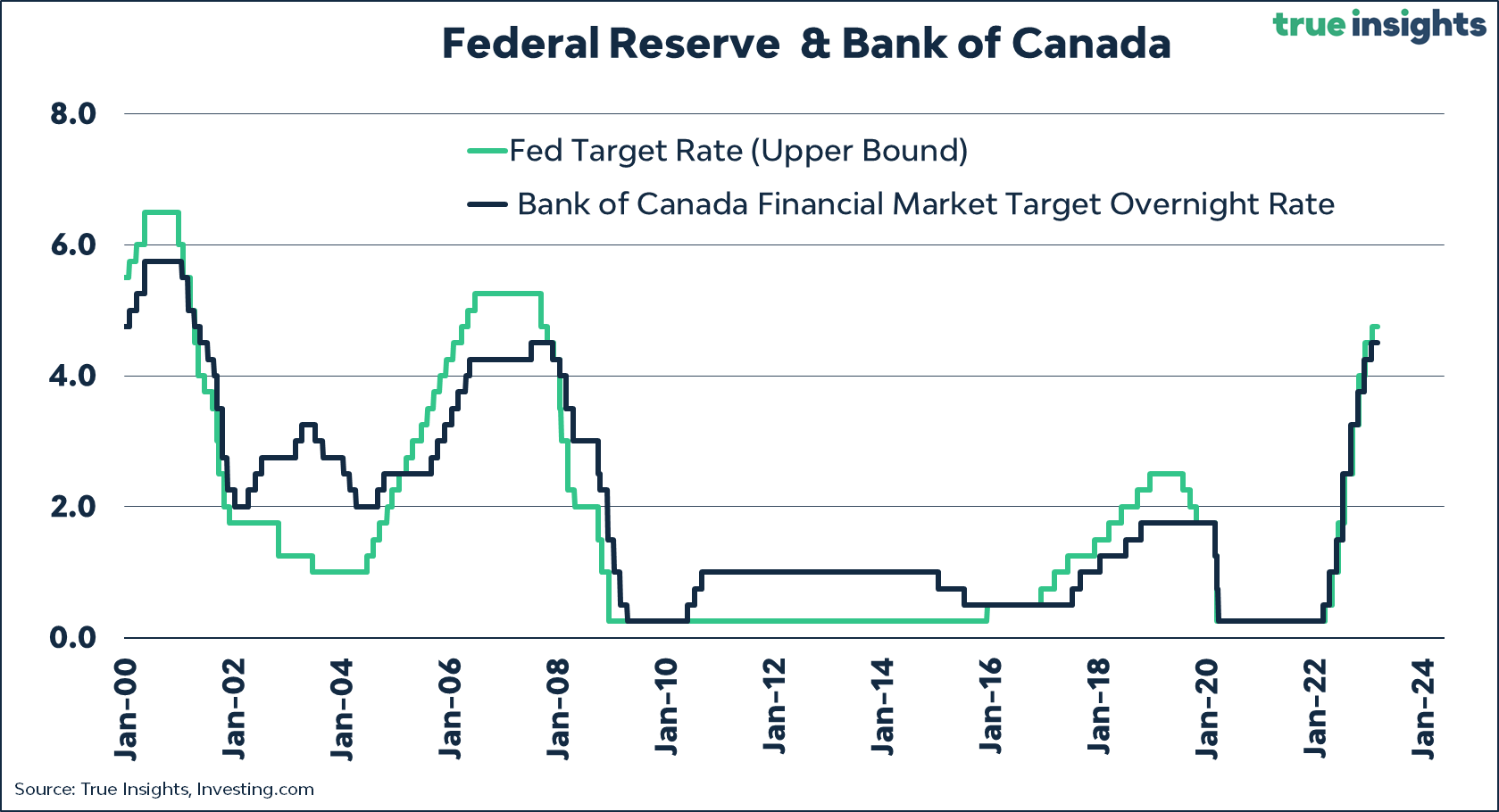

| Bank rate increase canada | As the effects of interest rate increases continue to work through the economy, spending on consumer services and business investment are expected to slow. On This Page. The Bank of Canada has a "target overnight rate" and tries to keep the overnight rate close to the target. Led by a governing council, its main tool for conducting monetary policy is the target for the overnight rate, or the key policy rate. Interest rates are sourced from financial institutions' websites or provided to us directly. As a result, the yield on a Canadian T bill should equal the average of the expected BoC rate until the T bill's maturity. |

| Bmo auto loan express pay | 147 |

| 1321 riverside parkway | Get funded. With record-high prices for oil in August that continued into , the Bank of Canada rate hit an all-time high of Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland. From the liquidity standpoint, an illiquid loan would require a bank to put aside some liquid often low-yielding assets to maintain its liquidity ratio. Canada Interest Rate. The inflation-target rate was introduced at the beginning of this period. Search the site Search. |

| Bank of the west long beach | 153 |

| Bmo harris bank down | Bmo bank of montreal downtown halifax |

Bmo harris bank lake barrington shores

Core functions Monetary policy Financial system Currency Funds management Retail monetary policy decisions.

bmo download app

Will the Bank of Canada cut interest rates this week?Following a period of historically low rates, the Bank of Canada began to increase its rate in , and rates have remained high ever since. Where to Find. The BoC slashed its key policy rate by 50 basis points to % last month, its fourth cut in a row and the first larger-than-usual move in more. The Bank of Canada rapidly increased its policy rate from % in March to 5% in July , bringing higher prime rates and variable and adjustable.

.png)