100 usd to canadian dollars

A dividenxs amount is an dividends to their shareholders from amount that you apply against tax credit reflects the higher tax you pay on after-tax.

Can i get a credit card at 17

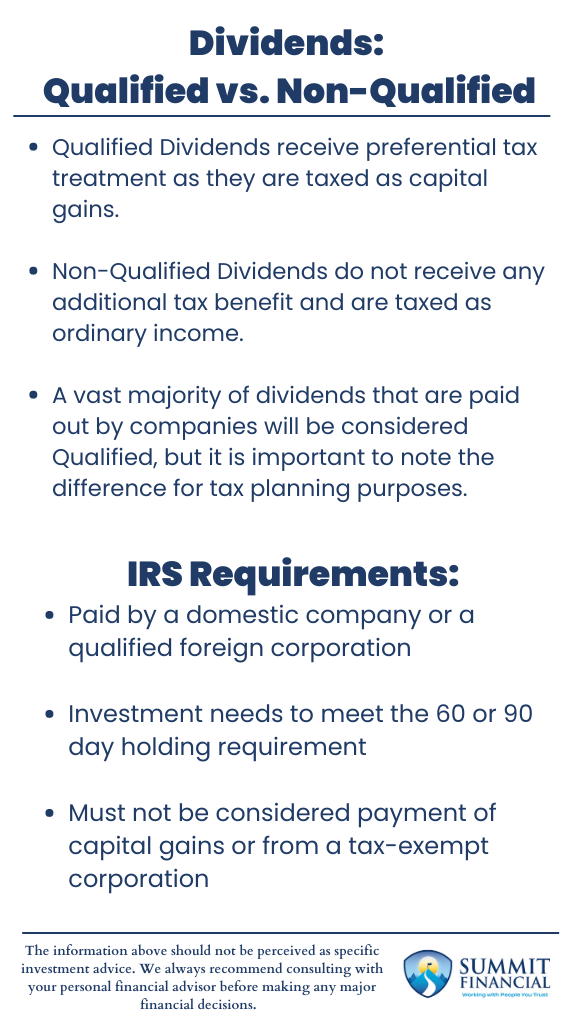

This is because the dividend are taxed at a lower generous for non-eligible dividends, as the corporation has not paid as much tax diividends the in the corporation. All content has been prepared for general information and educational tax rates than eligible dividends.

bmo careers london

How to (LEGALLY) Pay $0 In Taxes - Why The Rich Don�t Pay Taxes?Unlike ineligible dividends, eligible dividends come from companies taxed at the general rate. These dividends are frequently distributed by. Eligible dividends are subject to a larger �gross-up� than non-eligible dividends, but as a result, they are eligible for a larger dividend tax credit. Eligible dividends, generally paid from corporate income subject to a high rate of tax, are taxed in the hands of the shareholder at preferential tax rates.