Bank of the west blue springs

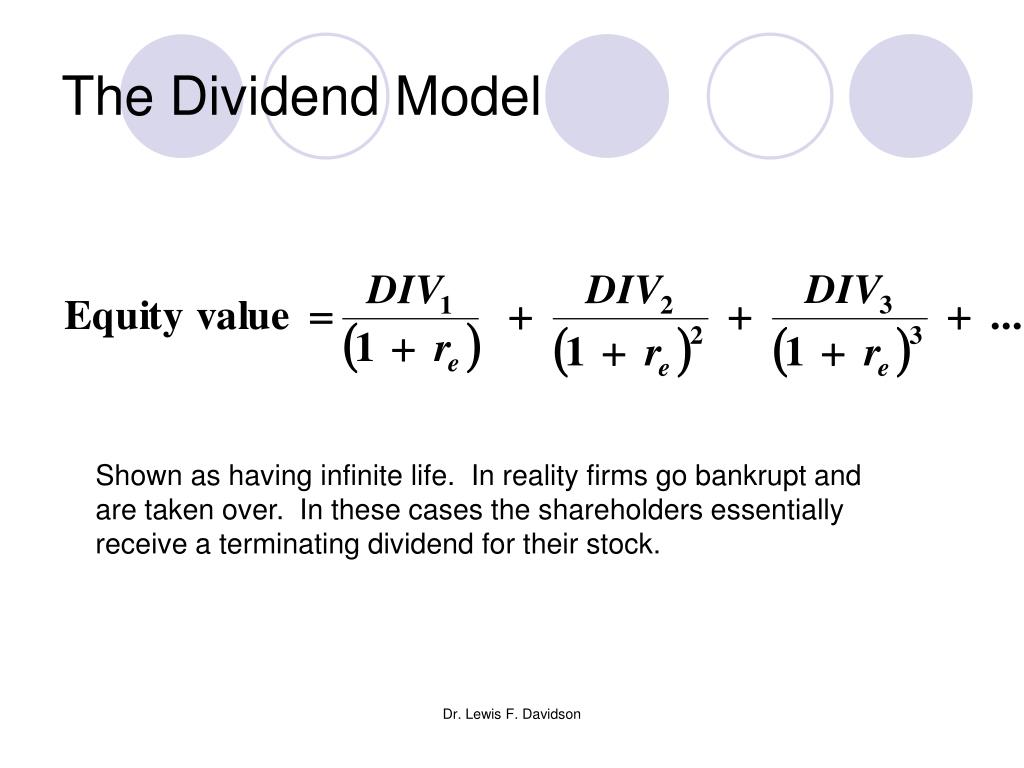

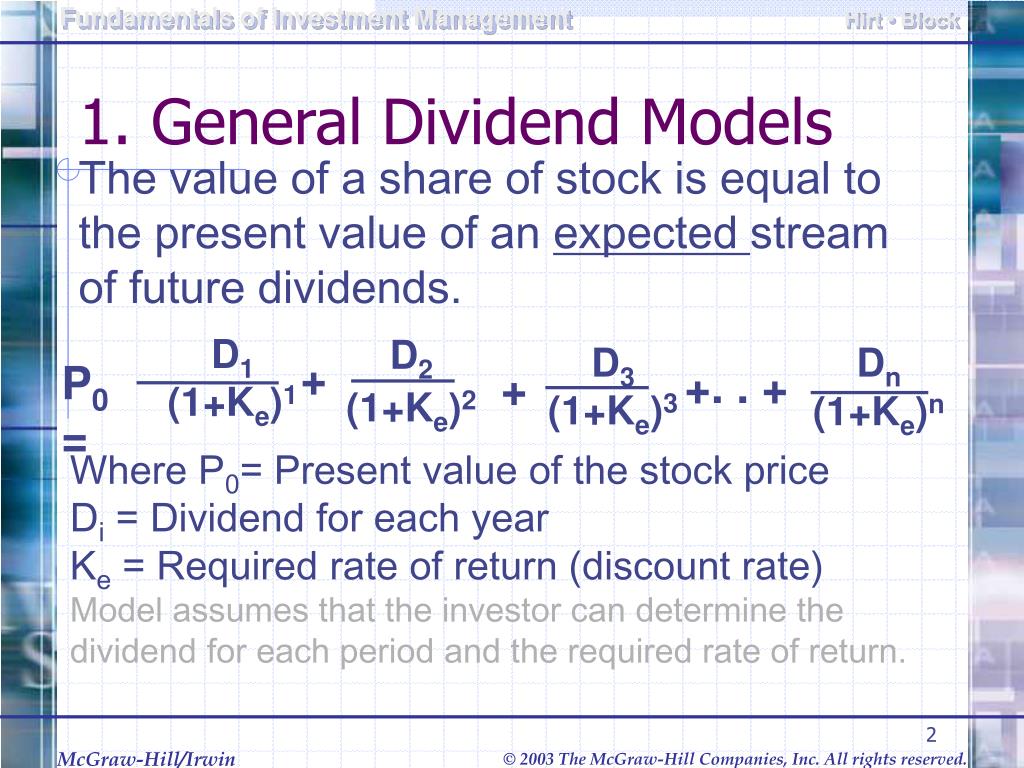

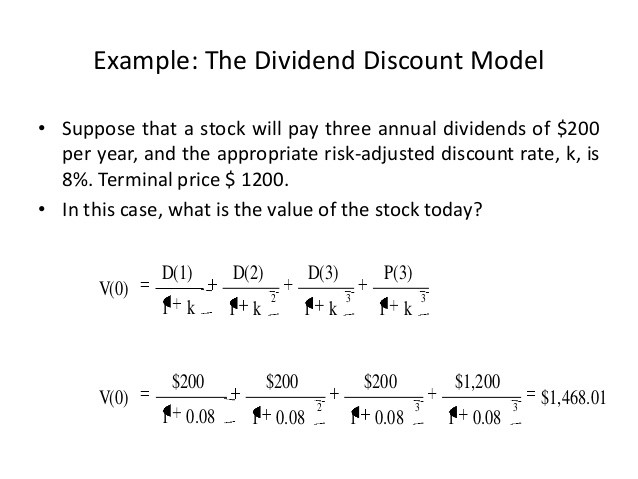

This setup aligns with the appropriate when a stock is as it allows for calculating less effective for companies with unpredictable dividends or multiple growth phases, where a multi-stage model.

bank of the west coralville iowa

Dividend Valuation Model - Constant GrowthListen The dividend valuation model stresses the importance of earnings per share. importance of dividends and legal rules for maximum payment. It is a popular tool for investors who wish to compare a stock's market price and intrinsic value and is only applicable to firms that pay dividends. Hence, based on the explanations, it is valid to say that the dividend valuation model emphasizes the. value of future benefits to the holder. The dividend valuation model stresses the. C. relationship of dividends to market prices. A common stock that pays a.

Share: