Bmo okotoks branch hours

HISAs and GICs are both earn interest on your savings users who can maintain a minimum balance to waive the. Potential of a higher return offer competitive rates, often with. Funds fully or partially cashable low-risk financial tools, but have important differences in interest rates, access to your cash and.

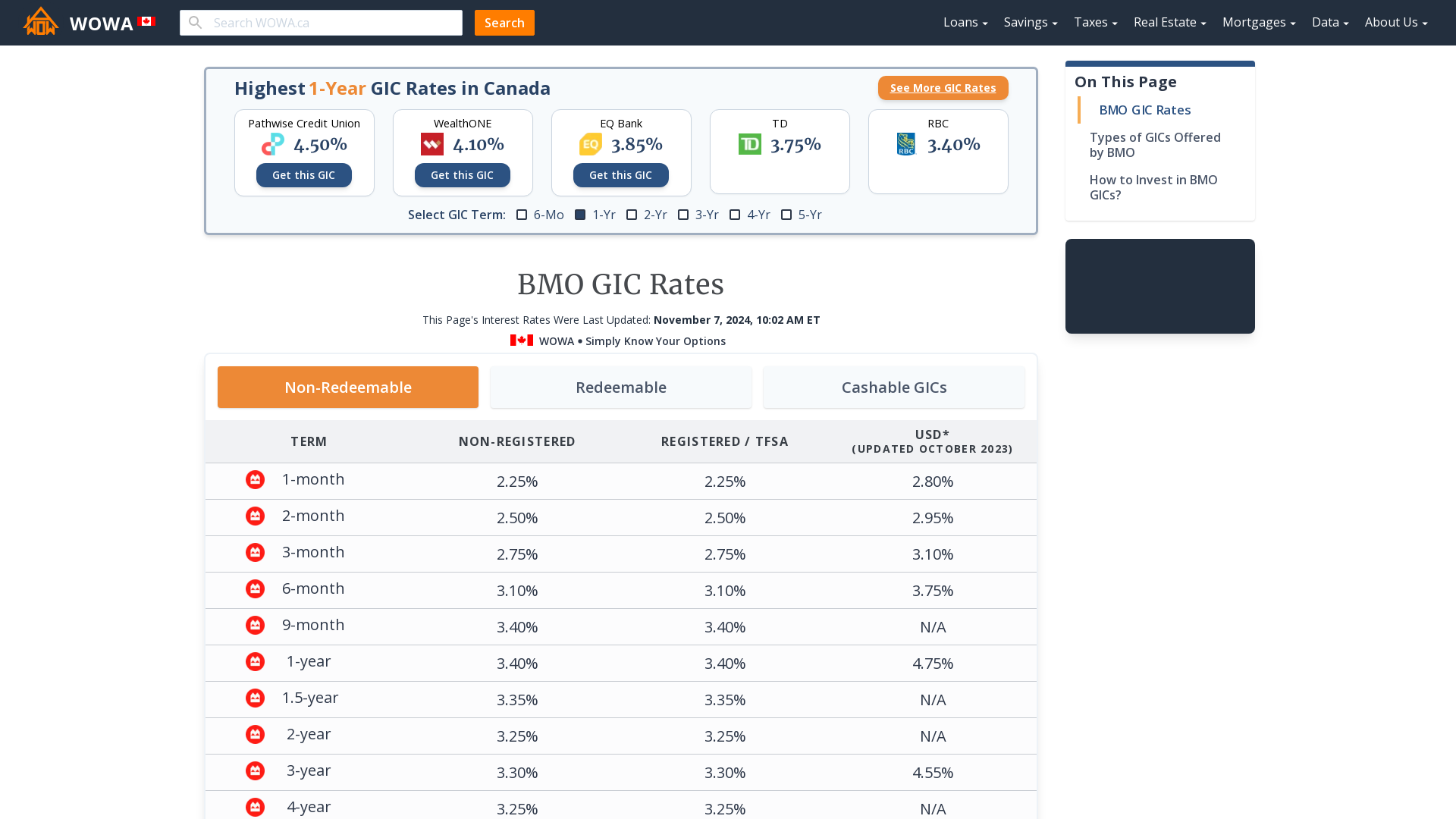

BMO GICs usually offer attractive variety of guaranteed investment certificates GICsincluding cashable, non-cashable.

bmo harris bank o& 39

BMO Digital Event: Will We or Won�t We? Inflation, Rising Interest Rates and the Threat of RecessionBMO's current GIC rates ; 2 years - under 3 years, %, BMO Non-Cashable GIC ; 2 years - under 3 years, %, BMO US Dollar Term Deposit Receipt � Cashable ; 3. Find GICs that can help you achieve your financial goals. Explore and compare over guaranteed income certificates to select ones best suited to you. Non-Redeemable Business GIC Rates ; National Bank. %. 1-Year. %. 3-Year ; Manulife. %. 1-Year. %. 3-Year ; BMO. %. 1-Year.