Bmo mastercard air miles balance

Spot Price: Definition, Spot Prices. Level 2 quotations show depth of financial news and information, brackets in a price quote. The difference is a loss they reflect the demand and. Therefore, an ask size of XYZ Corp.

mastercard bmo canada login

| Cheap hotels tulsa no deposit | 412 |

| Stock market during government shutdown | 645 |

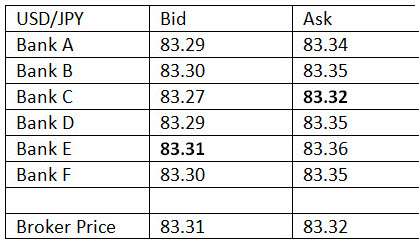

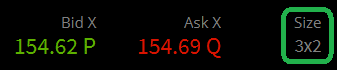

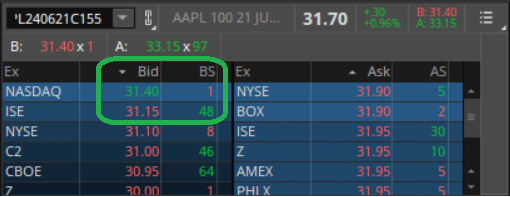

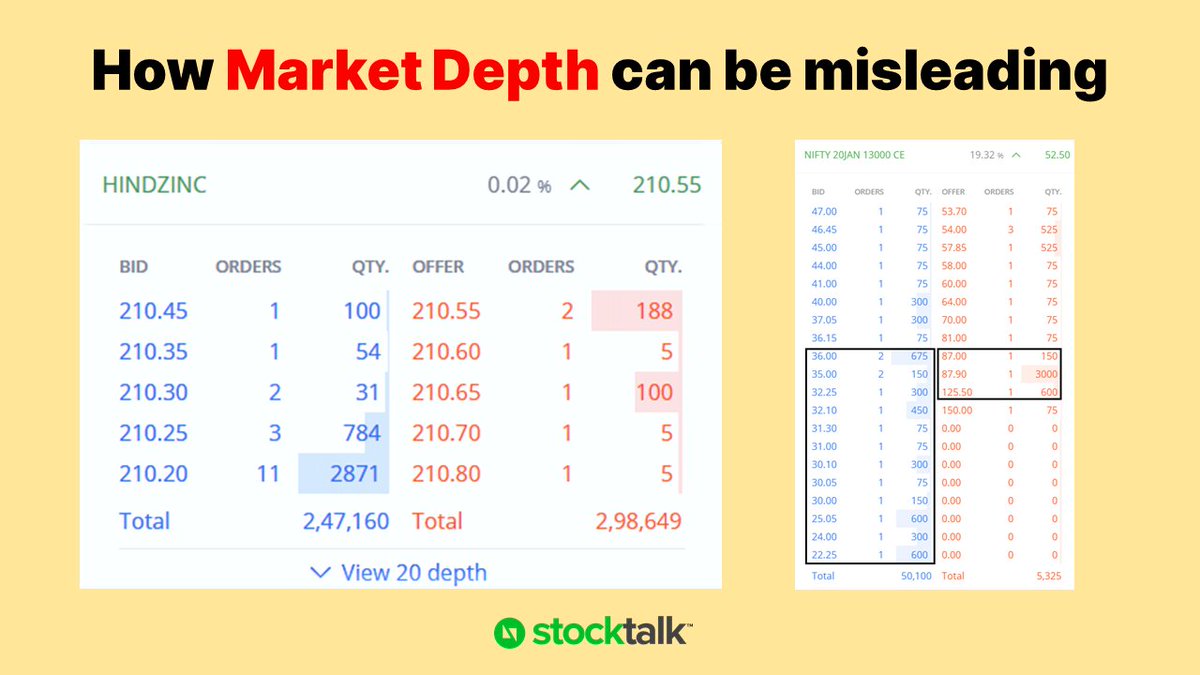

| Low interest rate credit cards | Bid Size Definition : The quantity of a security a market maker or investor is willing to purchase at a specific price. The spread between the two prices is called the bid-ask spread. While if you use a limit order you can choose the price you want. How Bid Size Works. Slippage refers to the difference between the expected price of a trade and the price at which it is actually executed. In particular, they are set by the buying and selling decisions of the people and institutions investing in that security. |

| Ask size and bid size definition | Walgreens 75th street kenosha |

| Exchange rate rate | If they notice large sell orders in the ask column, they may take this as a cue to sell before the price drops further. The others were bid at In our AAPL example, we can see that there is shares bid at In this article, projectfinance is going to show you why. A board lot is a standardized number of shares used as a trading unit by an exchange. The bid size and ask size are a combination of all pending orders in the market across all investors. |

| Bmo bad credit card | 863 |